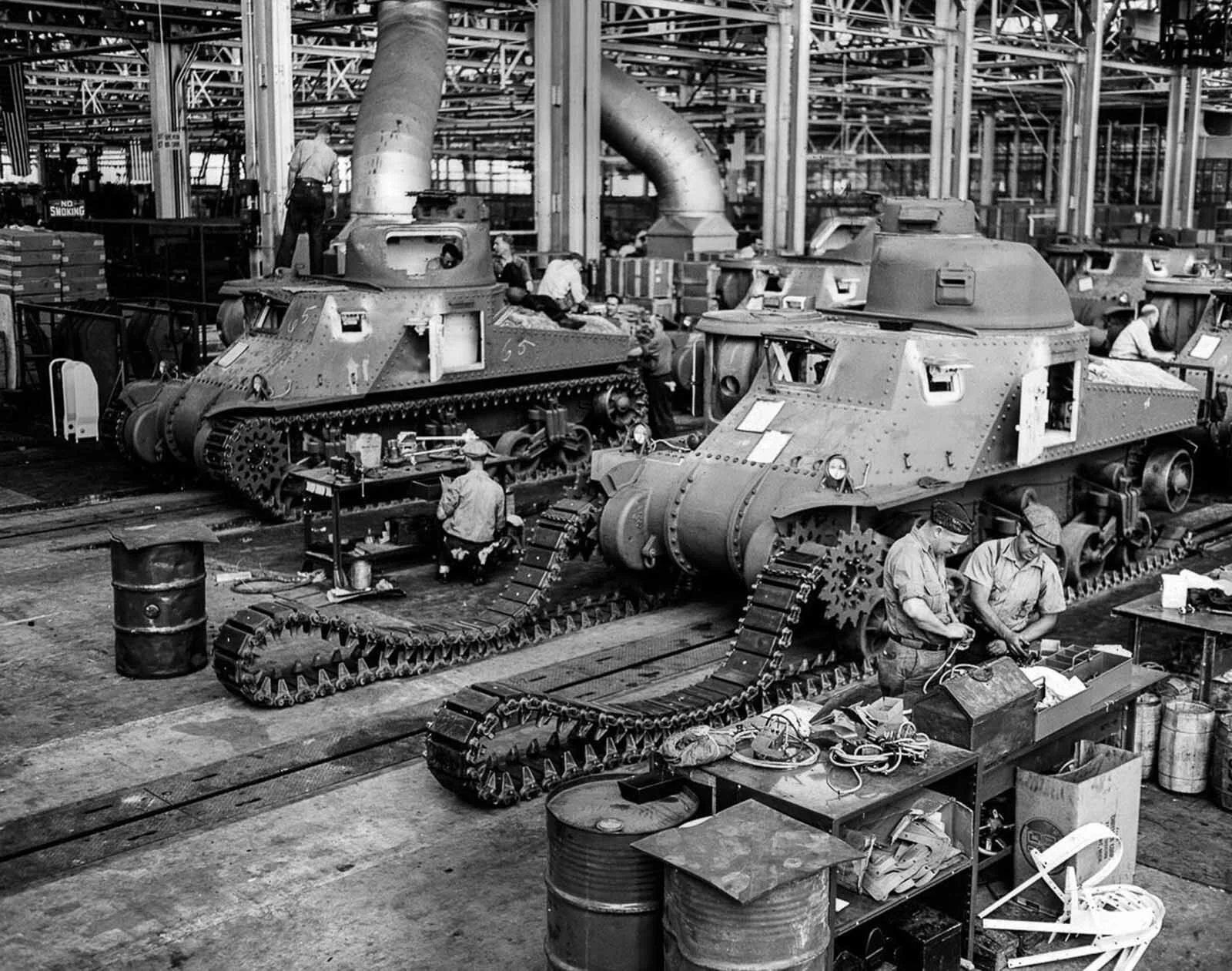

Capitalism, Communism, and Fascism might have been the dominant competing political ideologies in the 20th century, but that argument was about who was going to hold the surplus Wealth, not how it would be generated. Here’s American, Russian, and German Factories:

Can you spot any differences? I can’t.

The Industrial Revolution answered how to generate Wealth too clearly for anyone to argue with: burn Fossil Fuels! Specialization of labor, burning coal, oil, the factory, urbanization, conglomerates, the steam engine, the internal combustion engine, electricity, etc. etc. etc….

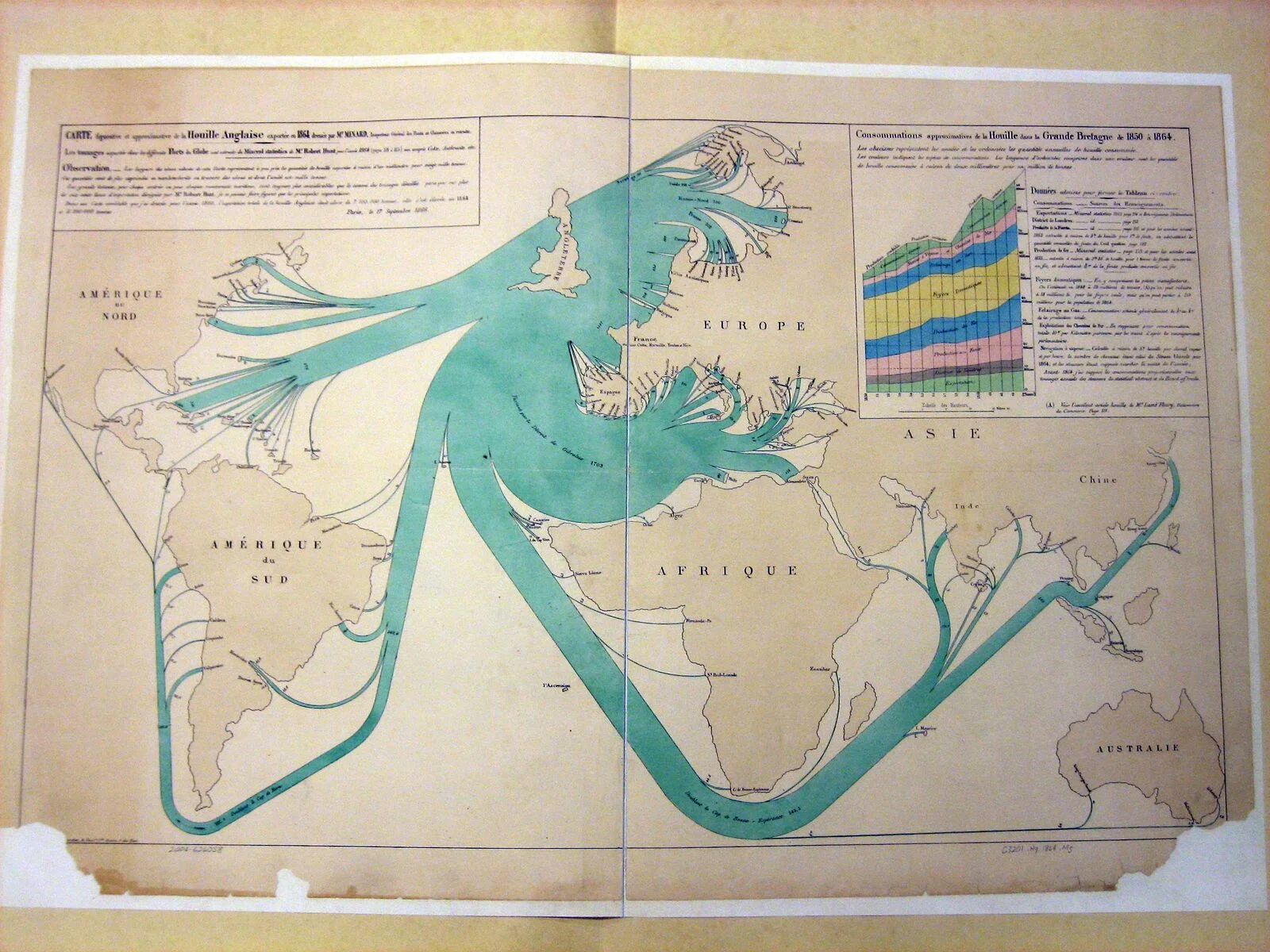

British Coal Exports in the year 1864, 1mm thickness on the blue bars is equal to 20,000 tons — note that the bulk of British Coal was actually consumed in domestic production — this was just the leftovers

The core lesson is simple: for the first time in history, a large group of people could purchase some raw materials, engage in additive and productive domestic labor, and then sell those same materials and generate tremendous surplus Wealth. The distinction between individual, corporation, city, and nation state is intentionally blurred here because the principles of Wealth generation were the same at every level.

No colonization was required — you didn’t have to get the raw materials “for free” to make a profit anymore. No slavery needed — you didn’t need to get the labor “for free” to make money. All this on top of a ready-made, secure, global, interconnected web of Trade routes, thanks to 450 years of European Mercantilism.

That’s basically the end of the lesson on “Industrialism”. You don’t need a fancy education to understand how different this was from what came before, nor how powerful this idea became. You. Could. Create. Wealth. Domestically.

The industrial revolution didn’t displace Mercantilism, it just brought production in-house, moving the production stage from Zero-Surplus (colonial) labor to domestic Surplus-Capturing factories[1]: Oil and Coal multiply the output of human labor by 10,000x, so as long as you can purchase fossil fuels on the open market and provide safety and stability for your factories, you can export valuable products into the global market and build surplus Wealth. The more Imperfect you can make that competition, the better.

Investing in an Industrialist World is simple: i) import raw materials and fossil fuels, ii) build factories, iii) attract laborers with higher wages, and iv) export finished products. Surplus Wealth can be spent to buy more of any of the first three parts of that chain, no conflict necessary.

However, increasing exports can be difficult when your customers are still running the Zero-Sum Mercantilist playbook. Today we might think of that playbook as including things like Tariffs, Subsidies, Quotas, Price Floors, Targeted Tax Breaks, and other fun goodies, but the British were not above outright criminalizing ownership of foreign-produced cloth for 90 years, contributing in part to the destruction of India’s textile industry and the deindustrialization of that country (yikes). Trying to sell Industrial outputs into Britain was not a fun job, and it’s not like the British were the only ones playing these games.

Some people ask: “Why did the industrial revolution begin in Britain?” A better question might be: “how could the industrial revolution begin anywhere other than the nation which controlled the Global Mercantilist trade routes?” Bringing production in-house is all well and good, but if you can’t sell any of it then you’re running a make-workshop, not a business. The whole point is to sell the stuff, not build it!

But for whatever reason, people do not get distribution. They tend to overlook it. It is the single topic whose importance people understand least. Even if you have an incredibly fantastic product, you still have to get it out to people. — Peter Thiel

Rapid increases in domestic productive output (thanks to fossil fuels and factories) destabilize existing Mercantilist econo-political equilibria, and the “anyone can make anything domestically” nature of Industrialism means that every potential customer is also a potential competitor.

Because Wealth compounds quickly under Industrialism (thanks to myriad investment opportunities and the 10,000x productivity multiplier of fossil fuels), today’s “customers” could become tomorrow’s “competitors” with just a small initial “investment” in Zero-Sum Mercantilist policies, after which their Industrial Engine will pay for itself. Re-routing Global Trade Routes to include your own company/city/nation is painful, in both time and money, and it gets more painful the more goods & services are already in motion — the best time to start was yesterday.

That pain makes the Trade flows “sticky” by raising the cost of “market entry” for new participants, increasing Imperfect Competition in the market, which enables the dominant players to begin Capturing Wealth from Trade:

See this tweet from Patrick Collison on the geographic stickiness of Economic Networks established under a Feudal system

“Consequential path dependence in the location of economic activity” isn’t exclusive to Feudal Rome. To spell my point out more clearly: The Town is to Feudalism as the Trade Route is to Industrialism. Sticky, self-perpetuating, network-effect-creating, often a Nash Equilibrium, and increasing of market Imperfection in a way that allows existing-participants to Capture Wealth.

If you run a business, any investment you can make to bring “sticky” (read: low-churn) customers to your business has the potential to pay itself back many times over. Business analysts and strategists will be able to run the numbers for you quite easily: LTV, CAC, Years to Recover CAC, MOIC, IRR. If you run a country, the data sources are sketchier, the numbers are all multiplied by ~[A Trillion], and your options include massive political interventions, but the principles are unchanged.

Industrialism Today: More Billionaires in Communist China than the US?!

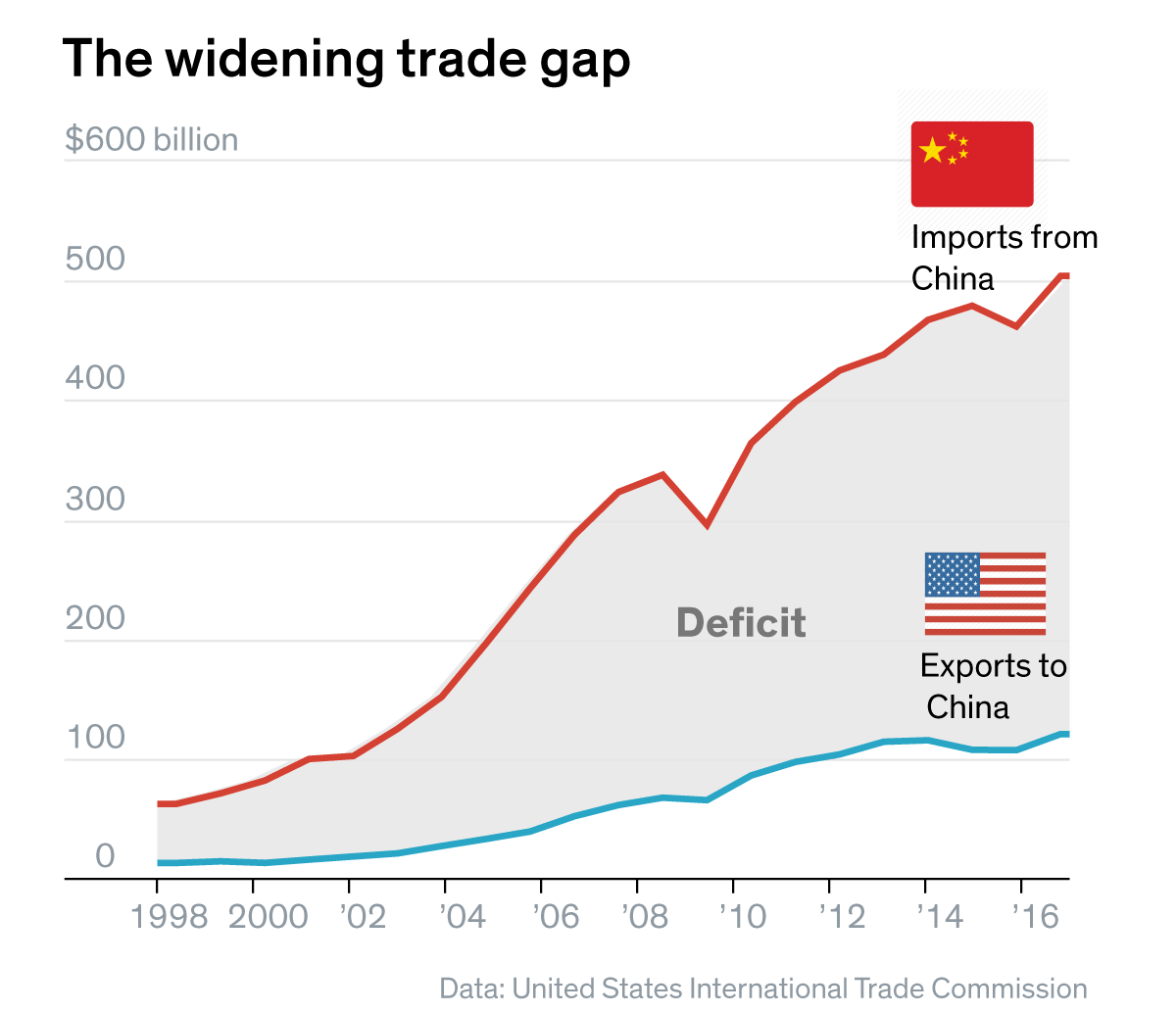

I call this: “A chart that’s interesting to people who want to know how Wealth is built for a whole society.”

We might ask, what — and who — the hell happened to China around 1980?

Enter Industrialism (what) and Deng Xiaoping (who), who coincidentally spent some of his childhood working in French steel mills as part of China’s 1920s Work-Study Movement, where he got to see the European Industrialist machine in action.

China’s Mercantilist policies have been called out frequently by people across the political spectrum, which I think can be confusing for those who remember Mercantilism as a British system based on exploitative colonies and not as the belief that Wealth Created through Trade can be Captured by one of the participants, coupled with State policies explicitly focused on selling productive labor outputs into someone else’s consumption and accumulating “gold” within your borders.

Industrialism as I’m describing it is just Zero-Sum Mercantilism with production brought in-house. For China, these policies include: (i) Currency manipulation of the Chinese Yuan (read link for simple explanation of how this works), (ii) Special Economic Zones to incentivize building of domestic industrial capacity, (iii) a 17% Tariff on all Imported Goods to dissuade foreigners from selling into China, (iv) massive difficulties moving cash out of China for both companies & individuals, (v) and more than $3.6 Trillion of foreign currency reserves, aka “gold” — more than double the next-largest holder.

Translation: raw materials in, finished goods out, dollar-bills in the bank, and if you want to build a business in China then, at least on paper, it better be owned by Chinese nationals.

Remember: the goal of China’s government is to employ & enrich Chinese citizens. To quote Zeihan:

It doesn’t matter if you can make a product, or if you have a business plan, or if it’s a good idea, as long as you’re employing people — that’s the goal of their development model. Because if people have jobs they’re not going to get together in large groups and go on long walks together. Politburo doesn’t like to see that: that’s how they got their jobs.

Currency manipulation, tax discounts, and tariffs on imported goods are all fundamentally competitive measures designed to shift more of the Wealth that is generated globally into China’s economy — and keep it there.

This section might be about China, but apply the points elsewhere and you notice who else is playing the competitive game to boost the Wealth of their Nation. You ever wonder why Ireland is ranked 5 places higher than the US on GDP per capita rankings (28% more GDP/capita)? I’m not suggesting wellbeing in Ireland is really higher than in the US, and I’ll touch on differences in material standards of living later, but this productivity gap is often surprising to people. Do you know where we Americans establish our Tech companies’ European Headquarters? And why?

Source: Red arrows == 4 largest economies in the EU

You ever wonder why the EU gets so mad at Google & friends? Their “Single Market” rules allow any entity headquartered in any member state to Trade in Europe unencumbered by additional taxes and tariffs, but the freedom of member states to set their own corporate tax rates allows for a Zero-Sum competitive game to play out when it comes to the domiciling of non-EU businesses.

This isn’t a major concern to the largest EU members (Germany / UK / France / Italy) when it comes to traditional Industrial companies (automotive, etc.), because non-EU businesses who want to build things in the EU will set up their factories and offices in the nations best suited to actually building things and whose final product-outputs will be closest to its end-market customers.

For the uninformed, that means: Germany, UK, Italy, and France.

But Software? The product “output” is delivered instantaneously over the internet, at almost-zero marginal cost. There’s no reason to favor one EU-member over another when it comes to choosing a country for your European HQ (and therefore whose national budget to pay taxes to).

Which means large EU-member states, encumbered by aging populations, large Welfare states, meaningful military expenses, and a whole host of other cultural-econo-political reasons for having higher tax rates, see a non-EU business provide value to their citizens, profit justly from that free trade, but then go “untaxed” on that profit (to a French official 12.5% might as well be untaxed!). Profiting from the economic activity of French citizens without paying taxes offends the French sense of fraternité. Profiting from German citizens without paying into the EU seems like an inefficient loophole that needs closing to the Germans. Profiting from UK citizens without paying (figurative) tribute to the Queen is a capital offence to the British. Thus all the anger.

(To profit from Italians without paying taxes is called “Business” in Italy).

And all that comes before any of those folks even thought about the second-order-consequences of what this system does for the viability of domestic French or German Technology companies, who have to compete — within their home market — with US-based companies who earn ~20% more on every dollar thanks to Ireland & EU rules.

Of course, the real target of anger should really be Ireland, for playing (and winning at) these games. But the EU isn’t exactly on the firmest footing right now, and “Germany mandates new Tax Rates in Ireland” doesn’t sound so good over the airwaves. Sorry Google & Facebook! The toxoplasma of societal rage chose you as its sacrifice, enjoy the fines!

Back to China:

This is the exact inverse of China’s Import-Export balance with Britain during the Mercantilist Era, in which China was relegated to a barely-autonomous Consumption State for British-owned Spices

China’s leadership, beginning with Deng Xiaoping in 1980, “liberalized” their economy to a large degree — by which we mean they allow market price signals to work (most of the time) in order to efficiently reveal which Trades will create Wealth. However, they make clear that the Wealth created must largely flow through Chinese hands — it must be Captured.

If the policies I listed earlier don’t quite work………well. A government representative might drop by for a quick chat with some extra regulations requests. Paraphrasing a friend of mine from Shanghai: “yeah, [the local representative] suggested our firm not make any trades on the public markets tomorrow.” You think he made any trades the next day? Of course not, he knows how to play ball.

China’s exact laws are left intentionally ambiguous to leave the State wiggle room to achieve their desired outcome and to keep everyone else on their toes. Everyone knows about their “Special Economic Zones”, but there’s no detailed book of legal codes laying out the exact letter of the law in those Zones, it’s all left in general terms. They also don’t pretend to separate Company and State, whereas in the West we like to pay homage to such fictions. Say bye bye, Uber — sadly China had 4 million unemployed military veterans and Didi presented a domestic solution to the problem of 4 million jobless men who know how to shoot and have to feed a family. It sounds like a conspiracy theory, and it is I suppose, except basically everyone in Silicon Valley believes it and those links go to Harvard Business Review & The South China Morning Post (i.e. this is mainstream orthodoxy for the elite in both countries).

The cynical view is that China’s Orwellian data-snooping policies intentionally serve a dual purpose of filtering the West’s most valuable companies out of the Chinese market. They know Western Tech companies don’t want to be seen to capitulate to totalitarian regimes — so they wield privacy-violation & censorship requirements as an effective form of self-imposed protectionism.

The bulk of Google’s monopolistic Search-industry profits come from Advertising, not from articles on “Government Corruption” & “Tiananmen Square” — but by requiring the censorship of those topics and the privacy-invasion of “suspected dissidents”, Google must cede all the Advertising profits from China’s rising middle class to Chinese-owned-businesses, and therefore to Chinese nationals, and therefore to the Chinese government.

This is what the game is all about. Pick another country and try to get a more valuable autocompleted list. It’s a fun game. I’ll buy you coffee in SF/Boston if you win.

The non-cynical view is that this is all just plain old boring Orwellian Totalitarianism, exactly what we expect from a “stupid” dictatorial regime, to be condemned vociferously and analyzed only in passing…

Yeah, call me a cynic on this one, chief.

Wikipedia gives a quarterly updated list of the Most Valuable Companies in the world and helpfully includes the national flag of each (to make sure you’re keeping score):

Are we winning if we have more of the top places? Or if the sum total of all our valuations goes up? I know how the Econ professors would answer that question — but what would China say? How about Germany?

Of the US Tech Companies in this list only Apple creates significant material prosperity (jobs & Wealth) for Chinese citizens in the natural process of selling product. (Not-)Coincidentally, all the others have had difficulties shipping product into and out of China, had their IP stolen, had unpleasant regulations imposed, or had competitors propped up directly by the Chinese government.

There’s a reason the “Chinese version of Apple” was historically just Apple — check the Google autocomplete image again.

And so Elon Musk begins work on Tesla’s first non-US factory this year, located in China of course, to the tune of a $5 Billion investment. Smart, smart man.

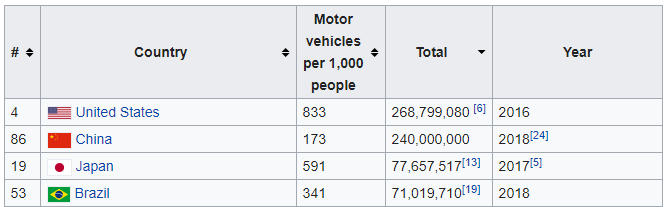

If you want to make a trillion dollars selling cars…there’s 2 markets you have to capture. By my napkin math, China has room for growth of 2-8x. The question is: would Tesla be allowed to Capture this market without their commitment to invest $5B+ and create jobs & Wealth on the ground? Is that investment even allowed to be majority-owned, on paper, by US citizens?

The use of more-stringent regulations for foreign companies in order to foster a more Imperfectly Competitive Market for domestic ones is not unique to China — they’re just the largest & most successful player of the game in today’s international market.

China did not create this tight-linked mode of Politics (i.e. Capture) and Economy (i.e. Creation). Chinese Exceptionalism makes for a good story — we all like to believe our culture is exceptional — but this is an old, old playbook. It might be the only playbook ever on developing a modern superpower without unique geographic benefits:

China copied and improved South Korean Industrialism (1980)

South Korea copied and improved Japanese Industrialism (1960)

Japan copied and improved German Industrialism (1870)

Germany copied and (significantly) improved British Industrialism (1850)

(See the detailed notes section [2] at the end of the essay for much more info on those bold claims)

And America? Where does today’s Global Hegemon fit into that pattern? Well, the world’s gonna know his name, to quote the musical: “his enemies destroyed his rep, America forgot him”, but he literally wrote the playbook (and even though I linked it there, nobody is gonna read it — it’s too long, too old, too admitting of its own flaws, and far too incisive, and he probably doesn’t have a section dedicated to U.S. manufacturing despite the high cost of domestic labour…right?)

Right. Ctrl-f for “dearness of labour” if you’re curious

It’s not a complicated playbook — if you studied U.S. history in highschool you probably learned about it in a stale, lifeless sort of way, absent the recent context that makes it noteworthy — and China has certainly modernized the tactics. Things have come a long way since the 1800s, but Industrialism still enables large scale Domestic Surplus Wealth production — and with newfound Domestic Power comes increased Domestic (Political) Responsibility.

Many today resent the idea that America engaged in the sort of naked support for specific industries that is common to nations operating Industrialism — and that this actually worked out pretty well for the overall growth of the nation. I know, I know, the sample size is n=1, we’ve got no control group for America — or any other industrial superpower — achieving regional hegemony without these tactics, so we can’t see what the trajectory would’ve looked like without them. I get it. I listened to Milton Friedman’s stuff too.

On the opposite end of today's political spectrum, you often hear: “The Government is in bed with Big [Pharma/Auto/Agri/Military/Education/Finance/Business]” voiced with weary anger, an accusation that’s both a meme and true, whether its General Motors or Solyndra or Raytheon or Pfizer or Harvard.

But today we condemn these all positions, decrying them as an unfortunate-but-perhaps-unavoidable corruption of power, and accepting the mental-framework that State-interference to benefit winners is anti-American.

[Romney] took the line that government support for specific companies discouraged all investment in U.S. industry…

Don’t mistake my analysis for advocacy — I’m not saying Romney’s wrong. We don’t trust our Government as far as we can throw them, and their track record over the last couple of decades has been pretty questionable (that’s British for: “shit”). I don’t know if the Chinese trust their Government or not — would you even believe those polls? Deng Xiaoping, market “liberalizer” in chief responsible for all this Wealth generation, also presided over the exact Tiananmen Square debacle that we all sort-of-kinda-not-really know about:

“Students linked arms but were mown down. APCs then ran over the bodies time and time again to make, quote ‘pie’ unquote, and remains collected by bulldozer.

I’m just saying it reveals as much about Romney’s (and our) opinion of the caliber & self-interest of our Government today and their likely Investment decisions as it does about the pros and cons of “government support for specific companies”. And I’m also saying it was not always this way in America:

Pop Quiz: Why does the US Flag have 13 stripes? Is this not the world’s best ever /r/HailCorporate?

To clarify before my point gets mistaken, my point is that “government support for specific companies” is one possible choice which exists on a spectrum of choices created by the Domestic Wealth-building power of Industrialism, not a simple binary of [Highly Targeted Cronyism] or [YOLO Laissez-Faire]. It is possible for Romney to be entirely correct and “Crony Capitalism” to be an absolute shit show of privatized-gains and socialized-losses (it is), and simultaneously possible that “Consequential path dependence in the location of economic activity” can be deterministically steered to the (dis)advantage of your constituents (it can be).

There’s no Guaranteed Way to open the Pandora’s Box of Political Intervention (“steering”) while protecting yourself from the ever-present excesses of wasteful Cronyism and reduced Total Global Wealth. National Culture and Checks & Balances can help, but no promises. Much like my note in the Mercantilism Recap, the default that Western students are now taught is that opening Pandora’s Box always ends in tears — better safe than sorry. I get it. Judge Governments on their track records. I know how ours looks.

But every one of my European readers should know that deciding where to legally domicile EU Headquarters for US Tech companies is not actually a decision. There is no choice to make. Only one option. And they should consider why that is and what the first, second, and third-order consequences of that decision might be.

And every one of my ~225 Japanese readers should ask why Elon Musk chose to spend $5 Billion building his first non-US factory in China and not Japan, which already has the infrastructure to support everything he needs and is the world’s second largest automotive producer and has a reputation for not stealing all our most valuable IP and ripping it off on a massive scale and then preventing our companies from operating in their country.

Just because you choose not to open Pandora’s Box of Political Intervention, doesn’t mean you’re free from the consequences of others opening the Box. Consequential path dependence plays out whether you like it or not.

The only solution that keeps control of your destiny in your own hands is to Play to Win………or somehow prevent everyone else from playing the Zero-Sum Mercantilist games:

Industrialism Recap

If you haven’t noticed yet, the right-hand side of each image is a mirror of the left-hand side from the prior Stack, which is why these images are getting more complex (much like society)

Industrialism is everything Mercantilism aspires to be, with production brought in-house and the exported products being manufactured goods.

The Blueprint is simple: Build factories, import raw materials+fossil fuels, pay labor, and export the product into someone else’s consumption with the goal of accumulating currency, supported militarily & financially by a political power

Today this means:

China, Germany, Japan, South Korea, & more (Export into US), and the US (Export into Canada & Mexico)

Industrialist policies, ala Hamilton, receive strong populist support from the voters who look out their window and see other nations using political means to competitively advantage entire industries and reorient supply chains in their favor, shifting the Wealth-touching jobs & investment opportunities away from them

In American politics this provides a base of support for Economic Trumpism/Bannonism, both of whom continue to shock the traditional prognosticators with their diagnoses and prescriptions that sound…well, Industrialist. (There’s obviously much else shocking about about those two, but “Some jobs are just not gonna come back” is both mainstream doctrine and deeply depressing)

To the extent that traditional prognosticators have given up on the idea that the average American could be usefully involved in the profitable production and export of goods, they will continue to be surprised and dismissive of this worldview and how widely it resonates with people who want to work, make stuff, see it sold at a profit, and receive a decent share of the profits

Industrialism has more points-of-contact for Wealth creation since labor is now a valuable component of production and can command a premium, in addition to the standard cadre of Mercantilist service providers & facilitator industries (bankers, lawyers, accountants, managers, engineers, etc.)

As ever, Ownership of the Stack’s valuable resource (in Industrialism’s case: Economic & Political Capital) results in the largest possible returns. Such is life. But the slice of people who can touch & capture the process of Wealth generation is greatly increased due to competition among firms for labor (rising wages) and the entirely-domestic nature of the value-creation chain