J.P. Morgan, Godfather of American Financial Wizardry

I did work on Wall St. after graduating college, but I think Yanis Varoufakis, the former Finance Minister of Greece, former economist-in-residence at Valve, academic, author, and self-described “radical lefty” did a better job than I ever could describing the modern Financial System at a talk he gave in Boston last year:

“The beauty and ugliness of Finance, of Banking, is that it is a Magical process. Because once we moved from the [Feudal] Landlord to Edison and Henry Ford, it became impossible to finance Capitalism simply via the accumulated Wealth of some rich person. There was never enough money in the hands of any financier to provide Edison with the money he needed in order to set up his networked firm. So you needed banks to conjure up money from nothing…

There is a common fallacy in popular culture that banks operate like vaults. Whereby you and I put our savings in, and somebody else borrows money that comes from our savings. And that the banker makes money from the difference between the Interest rate that he pays us for depositing our money into his vault, and the Interest rate he charges the borrower.

That is not what is going on.

If you go to a bank tomorrow morning and you get a loan, the money is going to come out of thin air. The bank will create it out of nothing. It’s really very simple. You get $100,000…what will happen is someone just types $100,000 into your bank account….the hope of the banker is: you are going to use this money productively, earn money from the loan, and then you will give the banker back the money that will tie up that lose end. With Interest.

To the extent that this works, it really works magnificently.

It’s a bit like a banker being a specially gifted Magician who has a very long arm and can push that arm through the timeline. He pushes his hand into the future, grabs value that has not been created yet, snatches it from the future, brings it to the Present, and hopefully you do productive things, and you create the value that will repay the Future.

But once they learn the beauty — the glory — of doing this, they are in a privileged spot. Because they can take value from the Future, bring it to the Present…and because they are the mediators between Future and Present value they are ultra rich and central in societal processes. Political processes.

If you do this and it works, why not do more of this?

Keep snatching more value from the Future, and more, and more! At some point the Present can no longer produce the value that it needs to produce in order to repay the Present. At that point, those of us who have borrowed money have no capacity to repay it, a recession beings, people that work for us lose their jobs, they cannot repay their own loans, and then suddenly the book of the bank is full of loans that are “non-performing”.

At that point, if you and I, or those of us who have some money in the bank, realize that this is happening, we panic, we rush to the bank — this is a bank run — we ask for the cash — the cash is not there! And then you have the financial crises that we had in this country and in Europe from the 1840s onwards.”

I think the word “Capitalism” in the first paragraph should be replaced by “Industrialism”, but otherwise this is spot-on. If you want to make stuff — any kind of stuff — you have to understand this “magnificent system.“

And you have to understand that for people and groups of people who can deliver above the median, this magnificent system multiplies their power and Wealth by a huge factor. That’s why they call it Leverage.

Sidenote: How to Become a Magician

Varoufakis might like to disparage Wizards by saying they “don’t do any work”, which is true to the extent that “work” == manual labor. But that doesn’t mean it’s easy being a Wizard. There’s one immensely difficult problem that all Schools of Wizardry attempt to solve:

How much value can be safely snatched from the Future?

Any good nerd will know that there are many different Schools of Magic. If you want to be admitted for study today, enroll in your college’s Finance 1 & Finance 2 courses, as well as Econ 1 & Econ 2, which might (no promises) give you the theoretical underpinning needed to become an apprentice Wizard at Hogwarts an Investment Bank.

Accio Value!

The whole art of Financial Wizardry revolves around calculating exactly how much Value you can make from an [Asset], borrowing less than that amount to complete the purchase, actually extracting as much Value as you calculated, paying back the [Loan plus Interest], and then keeping all the value left over. Finance gives you the tools to discover what you should be maximally willing to pay today for an asset, and Economics helps you understand what others are willing to pay (and why the two seldom align).

Financialism Today: Magic Money Replaces Productivity Surpluses

As I said in the Mercantilism section, all these Stacks of Society exist together in the same time and place — this is not a history lesson, it’s about the different ways people build Wealth. The power of Finance has been felt since ancient times.

To the extent that there is a vaguely chronological narrative to the ordering of the Stacks, it’s because the likelihood of each Stack conferring the exact same Wealth-generating abilities upon its practitioners at any given moment in time is approximately zero. When one mode of Wealth-building has a Comparative Advantage over the others, it tends to dominate its local geography and time-period.

The Financial System exists as a Magical accelerant on Wealth-building for every other economic mode of being — Globalism most of all, followed by Industrialism. And that’s a really GoodThingTM (to the extent that you believe, like me, lifting people out of poverty, raising standards of living, and making your children better off is good).

What happens, however, when Financialism becomes so effective at Snatching Value from the Future that it becomes the dominant mode of Wealth-building?

Here’s the Money Shot:

"Actual Individual Consumption (AIC) per capita is more than 50% higher in the US than in the European Union as a whole!” Per RandomCriticalAnalysis, who wrote much more than you wanted to know about Health Care costs as they relate to AIC vs. GDP

Dark Blue bars == Actual Individual Consumption per capita

Light Blue bars == Gross Domestic Production per capita

[Actual Individual Consumption] is considered to be the better comparative measure of material standards of living between nations. Now go back to the chart and find a major country other than the United States where the Dark Blue bar (Consumption) is greater than the Light Blue bar (Production). There are only two — and one of those is itself an IMF-designated Global Financial Centre who might-or-might-not Brexit at some point in the near future.

How can you consume more than you produce? I’ll include an illuminating a quote from RandomCriticalAnalysis, whose chart I borrowed above:

My position is the average level of real resources available to residents of a country is the ur-cause of the vast majority of health spending everywhere and that AIC and AHDI are plainly superior measures of this…

Apprentice Wizards who internalized the principles of Econ 101 will intuitively understand the bold part. For everyone else: your fellow countrymen’s ability to pay determines what you pay.

For just about anything.

Now what happens when Financial Wizards offer your countrymen a higher standard of living by snatching Value from the Future and bringing it to the Present?

They say, quite reasonably: “yes, thank you, I would in fact like to have a higher standard of living. How did you know?!” This describes me too, of course. I went to college, as did most of my friends.

And then their ability to pay in the Present goes up, along with their line of credit.

When everyone’s ability to pay goes up, prices go:

I should honestly just keep including this chart in every essay I write.

That’s just Supply & Demand, Econ 101. And all that extra money — Value snatched from the Future — really is able to deliver meaningful quality of life improvements in the Present. The borrowed value accelerates today’s productivity, which means Americans end up with Consumption much greater than anyone else’s:

Quote per RandomCriticalAnalysis: “High US health care spending is quite well explained by its high material standard of living”

You have to ask: what supports this level of Consumption? Why can’t every other nation do this? What makes America so unique today? Sadly, there’s no pithy answer: everything important in life is multivariate, our economy today is complex, and Americans really are insanely productive on a per-capita basis, ranking around 11th-13th globally.

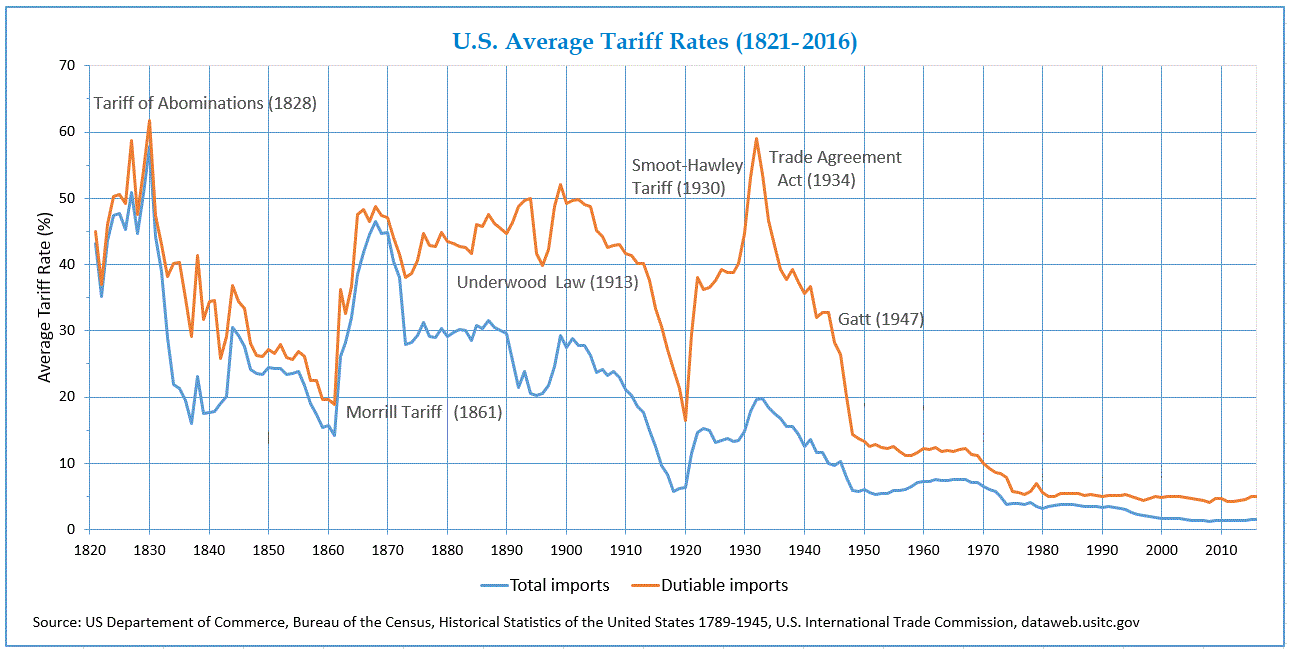

But Americans aren’t exactly running the same Industrialism playbook that they ran from ~1820 to 1945:

Read the y-axis closely for a laugh and don’t judge China too harshly for their 17% Tariff today — they learned from the best

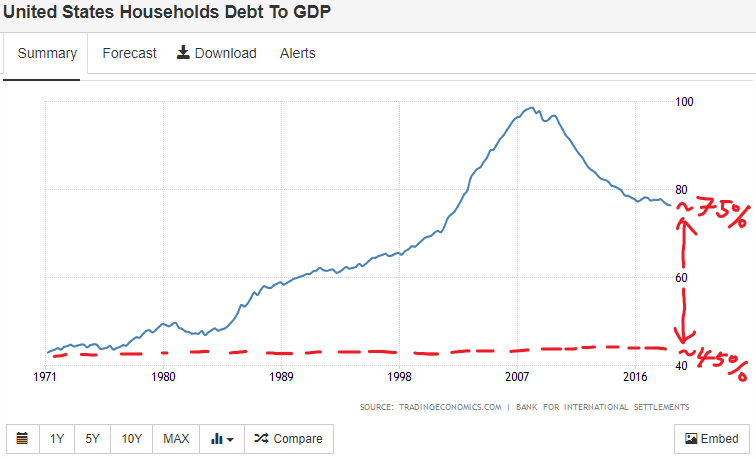

They’re running the Financialist one:

Source (I set start date to 1971)

Source (The growth in the Debt-to-GDP ratio works out to ~1.07% CAGR over this 48 year period. Real GDP Growth CAGR over the same 48 year period was ~2.77%)

My position is the average level of real resources available to residents of a country is the ur-cause of the vast majority of spending everywhere

“The credit itself incites to deeds of spending.” - Homer’s Odyssey

The awkward thing about highlighting the downsides of Financialism is it sounds like you’re arguing against “having goods & services that help people and raise their Net Utility.” Which is a cause that approximately zero people ever have successfully spread to others. “Let’s put it on credit” has bipartisan appeal in the most polarized period of the last ~150 years, which means a) it might not be the right answer all the time and b) it’s not changing anytime soon.

And I suppose in some ways I AM arguing against people “having goods & services that help people and raise their Net Utility.” I’d much prefer they had the freedom and power to be the Masters of their Fate, to independently pursue their own goals, to leave their children better off, to enjoy and experience Wealth. Wealth Compounds, builds on itself, in a way that mere goods and services cannot.

But I’m going to ruin my ability to get reblogged and shared and retweeted here (if I didn’t do that already by writing so damn much) by saying that this all basically works. By saying that it’s not the end of the world. This is not going to cause Armageddon. This is the new normal, and it became the new normal because this system allows America to create more Wealth than any system before it. It’s not a system others can copy — not unless they have their own Global Financial Centers and a Reserve Currency and a Domestic Productivity engine and an obscenely large Military to defend it all. But for America, it works: just check the Stock Market.

For those who can beat the median, individuals or whole groups of people, Leveraged Wealth generation unlocks magnificent standards of living. Instead of trading with partners to access Compounding growth, you can “Trade” with your Future self. That’s the magic, and it’s why the system accelerates its best performers.

For those who can’t quite beat the median…you will still enjoy access to those same standards of living, but you’re not going to have any Wealth left over at the end of the day.

Of course, all these costs can only scale so far. The middle class must be able to fund them — and since wealth in America is distributed exponentially, what’s all-consuming for the middle class is peanuts to the wealthy. So Wealthy begins with a race to $2,000,000, adjusted-annually-to-the-cost-of-education-housing-and-medical-expenses.

See you guys at the finish line.

There’s an instinctive urge to reach for Feudal solutions like Universal Basic Income here (“Take it and Tax it!”), and I’m not saying those are right or wrong in any particular case, and I see how the failures of Financialism loop back towards Feudalism, but it’s worth bearing in mind that Financialism is a system designed to reward the compounding of success. To the extent that you “reallocate” (euphemism) capital away from the people who are, like it or not, most-efficiently compounding it, you will necessarily be reducing the Total Wealth available to the whole group at Time = T+1

As with Mercantilism, it may be possible to make that Trade advantageously, but it is rare to see an acknowledgement of its downsides, coupled with the thoughtfulness to avoid them, from those who advocate making the Trade. Indeed, rather than coupling Financialism with Feudalism, the largest returns to society as a whole appear to have come when it was coupled with Domestic Surplus Production, through either Globalism or Industrialism, such that the Total Wealth available at all levels of society at T+1 always increases.

Financialism Recap

Borrow money, invest it in anything that will return more than it cost you to borrow, rinse and repeat and don’t stop repeating because everyone else around you will be doing the same thing, pushing prices ever higher. To run this Stack at the societal level requires at least one Global Financial Center and Reserve Currency status — giving those nations an “exorbitant privilege”.

Today this means:

America, Great Britain, Japan, France/Germany are all able to generate Wealth domestically by routing the flows of Global Capital through their own institutions

Financialist policies receive strong bipartisan support from politicians who know “putting it on credit” gets them points for delivering on promises without taking a hit with voters (in democracies) or soldiers (in non-democracies) by making cuts elsewhere.

For Americans, that means we spent $6 Trillion on wars in the Middle East over the last generation. Did anyone really notice? Whose bank account was pinched? Last I checked, we just cut taxes…and my lights are still on, my 401(k) is up, and gas is cheap

While this works, and will continue to work, it leaves a niggling anxiety in the back of regular citizen’s minds, certain that they’d never run their household finances this way. Of course they then take out $100k+ per child for college, put the car on a lease, the house on a mortgage, and pay for their phone in monthly installments — it’s not like they’ve got other options.

Financialism has fewer points-of-contact for Wealth creation as compared to Globalism/Industrialism, but touching those points results in higher returns than ever before due to the power of Leverage: being able to borrow from your Future self means you can more easily compound your advantages.

The increased Wealth of those who are successful under Financialism pushes prices up at the same time as Wealth-touching employment opportunities at the median shrink vs. prior Globalist/Industrialist opportunities.

Such pressure on society creates a tension that pulls things towards Feudal solutions…